Woodland Community College is dedicated to uplifting and empowering undocumented students and those from mixed-status families by providing accessible resources and comprehensive support to help you achieve your higher education goals. Our mission is to create an inclusive campus community that wholeheartedly embraces and supports undocumented students, mixed status families, and their allies. We are committed to offering the resources and encouragement you need to thrive, regardless of your immigration status.

Upcoming Events: Spring 2026

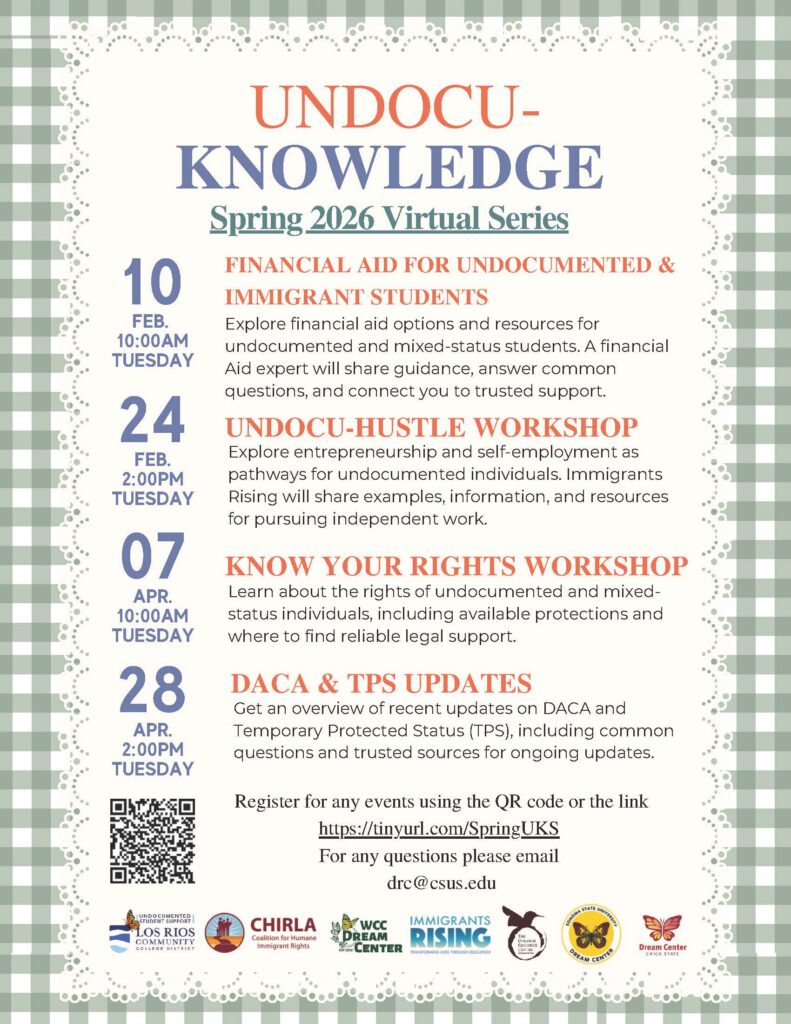

Undocu-Knowledge Spring 2026 Virtual Series

February 10, 2026 (Tuesday) – 10:00 AM

Financial Aid for Undocumented & Immigrant Students

Explore financial aid options and resources for undocumented and mixed-status students. A financial aid expert will share guidance, answer common questions, and connect you to trusted support.

February 24, 2026 (Tuesday) – 2:00 PM

Undocu-Hustle Workshop

Explore entrepreneurship and self-employment as pathways for undocumented individuals. Immigrants Rising will share examples, information, and resources for pursuing independent work.

April 7, 2026 (Tuesday) – 10:00 AM

Know Your Rights Workshop

Learn about the rights of undocumented and mixed-status individuals, including available protections and where to find reliable legal support.

April 28, 2026 (Tuesday) – 2:00 PM

DACA & TPS Updates

Overview of recent updates on DACA and Temporary Protected Status (TPS), including common questions and trusted sources for ongoing updates.

Registration link: https://tinyurl.com/SpringUKS

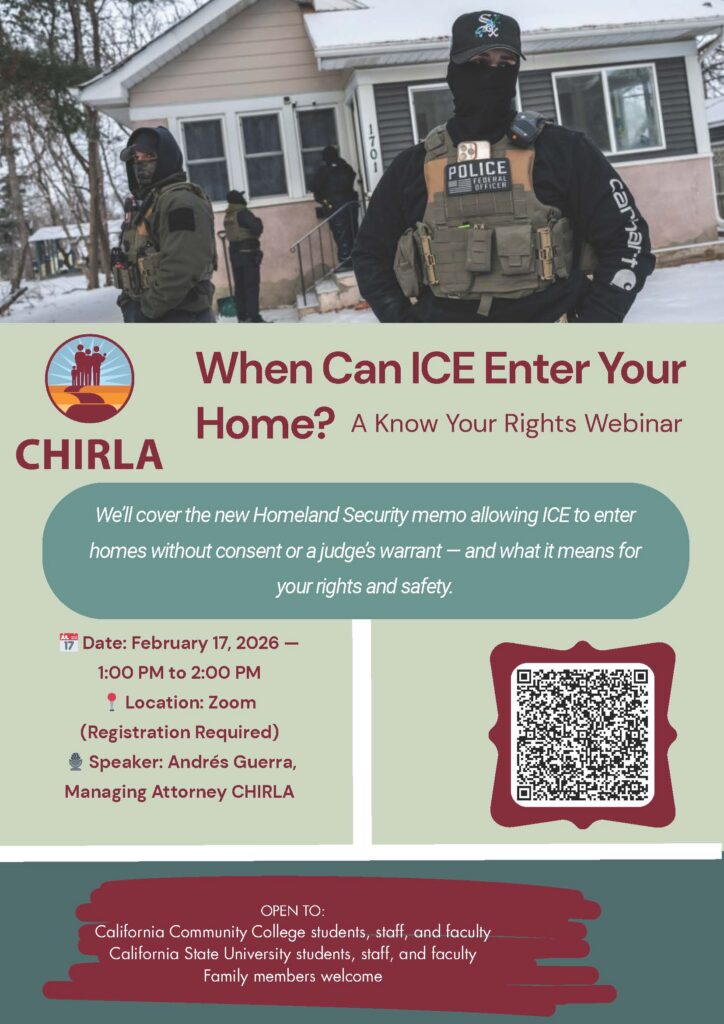

CHIRLA – Know Your Rights Webinar

When Can ICE Enter Your Home?

Date: February 17, 2026

Time: 1:00 PM – 2:00 PM

Location: Zoom (Registration Required)

Speaker: Andrés Guerra, Managing Attorney, CHIRLA

Description: Covers the new Homeland Security memo allowing ICE to enter homes without consent or a judge’s warrant and what it means for your rights and safety.

Open to California Community College and California State University students, staff, faculty, and family members.

Registration Link: Click Here

CHIRLA – Immigration Legal Services

Free Immigration Legal Consultations (In Person). Please register for your appointment ahead of time. If CHIRLA receives limited appointment requests, they will switch over to virtual consultations.

Available Dates:

Wednesday, February 4, 2026

Wednesday, March 4, 2026

Wednesday, April 8, 2026

To schedule your appointment please visit: findyourally.com

Legal Services

Legal Consultations

The Coalition for Humane Immigrant Rights (CHIRLA), in collaboration with Woodland Community College, offers free virtual and in person immigration consultations to WCC students, faculty, and staff. CHIRLA immigration services include:

- Immigration consultations

- DACA renewals

- Naturalization

- Family-based immigration

- Know your rights

To make an appointment with CHIRLA, visit findyourally.com.

Please note: You are not required to state the nature of your case/question to WCC staff to make an appointment with a lawyer.

General Services

We assist with completing the following:

- Assisting Undocumented, DACA, and AB540 students with the application and enrollment process

- Residency forms

- California Dream Act Application (CADAA)

- Financial aid guidance and scholarship information

- Connections to other programs on campus

- Referrals to outside agencies

- Financial Aid Assistance

Financial Aid representatives are available to answer any general questions regarding financial aid as well as assist with the completion of the California Dream Act Application (CADAA) or the Free Application for Federal Student Aid (FAFSA).

All assistance is FREE to any student interested in attending WCC.

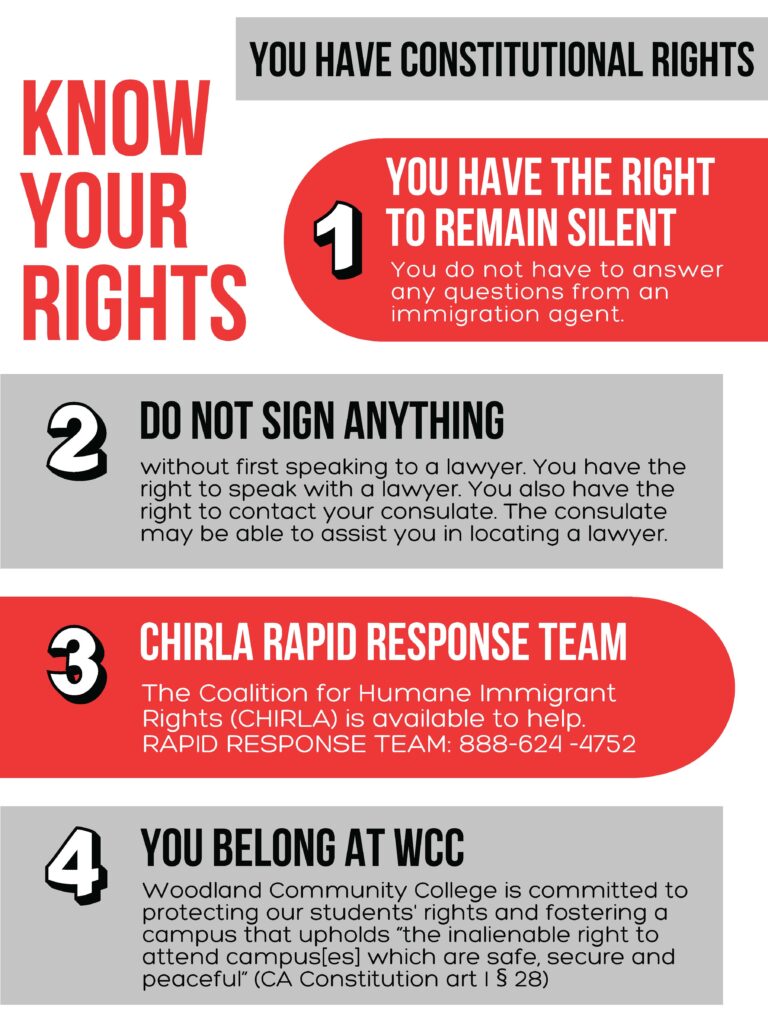

Know Your Rights

WCC’s Committment to Privacy Rights

Regardless of Immigration Status

At Woodland Community College, we are committed to fostering an inclusive, supportive, and safe environment for everyone in our community. Continued efforts to uphold the rights and well-being of our students include two critical areas of protection:

- The California Values Act (SB 54) and Response to Immigration Issues

Under the California Values Act (SB 54), our institution has policies in place to protect students and ensure a safe educational environment regardless of immigration status. This legislation limits the involvement of state and local agencies, including campus security, in federal immigration enforcement. Specifically:

- Campus personnel are prohibited from sharing personal information with immigration authorities without a judicial warrant or subpoena.

- All students, regardless of immigration status, have the right to pursue their education without fear of harassment or targeting.

We encourage all students to use or share the Know Your Rights handouts which are available in multiple languages: Know Your Rights Handouts: If ICE Visits a Home, Employer, or Public Space

- Anti-Discrimination Rights under the Equity in Higher Education Act

The Equity in Higher Education Act ensures students are protected from discrimination based on race, ethnicity, gender identity, sexual orientation, religion, disability, and other characteristics. This law emphasizes that:

- Every student has the right to equitable access to academic opportunities and resources.

- Acts of discrimination or harassment, whether by peers, faculty, or staff, are prohibited.

- Students have the right to report discriminatory behavior and expect appropriate action from the institution.

Federal Immigration Officials on Public College Campuses

Woodland Community College is a public institution, and a large portion of each campus is open to the general public. WCC does not have the authority to prohibit federal immigration enforcement officials from coming on campus. The areas on campus that are open to the general public are also open to federal immigration enforcement officials, such as outdoor spaces, parking lots, walkways, and other areas. However, many areas are considered “Limited Zones” and are inaccessible due to privacy protections. Limited-access spaces include classrooms while classes are in session, workstations, and offices.

Campus security are not required to and, accordingly, will not enforce federal immigration laws—a responsibility that rests with the federal government. When deemed appropriate, the Office of the President or designee will act as a liaison with federal immigration enforcement officials. Campus Security will neither contact, detain, question, or arrest any individual on the sole basis of suspected undocumented status nor work in concert with federal immigration officials for immigration enforcement purposes. Staff and faculty should contact the Office of the President if ICE appears in your area.

Woodland Community College is unwavering in its commitment to protecting our students’ rights and fostering a campus environment that upholds “the inalienable right to attend campus[es] which are safe, secure and peaceful” (CA Constitution art I § 28).

Campus Security: WCC Woodland Campus (530) 681-8782 / LCC Clearlake Campus (530) 954-0600

Resources

- Undocumented Student Action Week

- Undocumented Student Support E-Handbook

- Glossary of Terms

- Resource Center

- Legal Services

- Policy Updates

- List of scholarships & Fellowships

- Glossary of Common Legal Terms

- Understand the Differences: In-State Tuition vs CA Dream Act vs DACA

- CA Dream Act Application Checklist

- Mental Health Resources for Undocumented People

- Wellness Resources

Immigrant Legal Resource Center

- Know Your Rights – Red Cards

- Immigration Law Training Recordings

- Reports & Toolkits

- Family Preparedness Plan

- Rapid Response Network

- Know Your Rights Detailed Handout

- Know Your Rights Script & Skit

California Student Aid Commission

- Financial Aid & Resources for Undocumented Students

- California Dream Act Application Toolkit

- California Dream Act Application Resources & Training Video

Higher Education Legal Services

The Higher Education Legal Services Project provides FREE immigration legal services to California Community Colleges students, faculty, and staff. This California-funded effort connects trusted legal service providers with individuals in need to assess their unique case and plan for their future. Priority for services is given to students, staff, faculty, dual-enrolled students, noncredit course students, and adult education students. DACA fees for eligible students attending California Community Colleges are covered. Starting November 1, 2023 application fees for Advance Parole and Naturalization will also be covered by the program. Funds are limited.

Reach out to WCC Dream Center Staff:

Isabel Dueñas, (she/her/ella), Director of Retention & Student Life

Email: wccdreamcenter@yccd.edu

Phone Number: (530)668-3691

Instagram: wccdreamcenter

Location: Room 744

Hours of operation: Monday-Thursday 1pm-5pm

Hablamos Español